Many people think that the conventional banking and sharia banking have no difference. Some people even muslim also think that concept of sharia is blur because it's still owned by conventional banking and so on. A lot of people arguing and questioning what's the benefit i get if i moved to sharia banking. Expensive? higher rate than conventional? they said YES. So what's strong reason to move? Because pious and orthopraxy only become supporting reason and did not reflect into the spirit of business which is wealth.

Let us calculate cost benefit between the customer(source of fund), creditor(intermediary), and debtor. This is the simple real world comparison to analyze the difference with $10,000 in hand.

So what conventional bank can do with this $10,000? find credit and lend at 5% interest and find other borrower at 10% and then lend to street vendors at 25%. The bank is not particularly concern about what happen in this money other than gets repaid. Conventional bank has no conditional option, so what will happen if the debtor business crash or bankrupt? the unpaid loans and lender woes are in one package, set the domino effect to people at the same time. And we can't blame the power of compound interest. In fact, the interest do not need the actual cash/money so the original $10,000 can be pumped out until $100,000 artificial money.With the interest, we succeed to turn our $10,000 into much more and gain incredible profit for the bank. Imagine the number of repaid loans by business or world bank loan which reach more than $1 billion loan. How much they should payback by compound interest? We are all desperate by monetizing the debt.

So what sharia banking can do with $10,000. All transactions of Sharia banking always tight only play in actual assets and services (such as buy the machine, invest in business or lease the cars). The essential is, we can't compound the asset and service. The revenue sharing concept/interest on the other hand, allow cash to circulate and grow into the normal of SUM. Sharia banking is all about buying and selling something real with bank as intermediary. Rather than borrowing and lending something fleeting (conventional concept). Sharia reject the concept of time value of money by Adam Smith.

We witnesses the most dramatic financial problem in decades such as sub prime mortgage 2008 which impact to global financial meltdown. What the conventional bank can not do in this condition is that first, the ability to sell money when there is no money. To sell asset before they have underlying asset (asset exist). Allow debt to grow unchecked which make the borrower more desperate.

Interest creates artificial supply and not backed by the real assets which result into the high inflation, heightened volatility (measurement for variation of price of financial instrument over time derived from market price of a market traded derivative), and economic disparity.

As said by Obasanjo (Ex Nigeria President - developing country) in GA Summit Okinawa 2010 :

"All that we had borrowed up to 1985 or 1986 was around $5 billion and we have paid about $16 billion yet we are still being told that we owe $28 billion. That $28 billion came about because of the injustice in the foreign creditor's interest rates. If you ask me what is the worst thing in the world, i will say it is compound interest."

Developing countries start off relatively with small loan but saddled with growing debt for the next generations. Another example is our country (Asian collapse - 1997), Indonesia's foreign debt reach over 60% of its GDP.

Back to Nigeria, How $5 billion become $44 billion ($28 billion +$16 billion) between 1985 to 2000? Is it high interest rate? NOPE, it is only 15.6%. It does not sounds exorbitant, unfair, nor illegal. But in fact, we personally know if the bank charge high risk credit upwards of 30% of interest rates.

So how sharia serves better economic order?

we are business institution which run religion value. Not the religion institution which run the business value. So, gain the profit is a need and common in a business. But there are several aspects we protect in the business practice for the whole parties. Conventional creates capitalism and make the circulation of money serves only for certain people (from affluent to high network people). Sharia want to erase this by establishing win win solution and healthy business practice.

These are 3 values that we reject from the practice of conventional banking business :

1. Maisir (gambling) : Maisir is prohibited by Islamic law on the grounds that the agreement between participants is based on immoral inducement provided by entirely wishful hopes in the participants' minds that they will gain by mere chance, with no consideration for the possibility of loss.

2.Gharar

Ex : An Islamic finance term describing a risky or

hazardous sale, where details concerning the sale item are unknown or uncertain.

Gharar is generally prohibited under Islam, which explicitly forbids trades

that are considered to have excessive risk due to uncertainty. In

finance, gharar is observed within derivative transactions, such as forwards,

futures and options, in short selling, and in speculation. In Islamic finance,

most derivative contracts are forbidden and considered invalid because of the

uncertainty involved in the future delivery of the underlying asset.

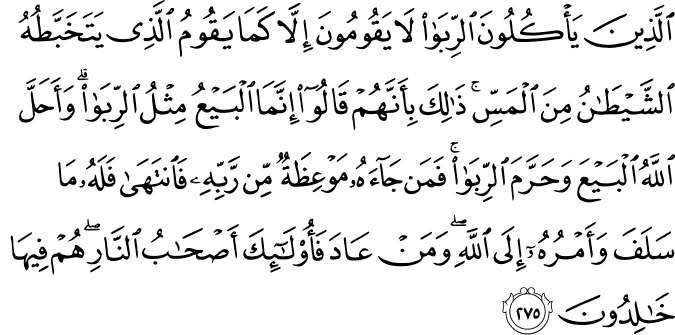

Sahih International

Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, "Trade is [just] like interest." But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah . But whoever returns to [dealing in interest or usury] - those are the companions of the Fire; they will abide eternally therein.By : Vanessa Alexandra

Source : Youtube, Cornell University Journal, Bank of Syariah Mandiri, wikipedia, quran.com.